reverse sales tax calculator ny

Use the Sales Tax Calculator to calculate sales taxes on a pretax sale price or in reverse from a tax-included price. See the article.

How To Calculate Sales Tax In Excel Tutorial Youtube

That entry would be 0775 for the percentage.

. Current HST GST and PST rates table of 2022. For tax years before 2018 you have until October 15th of the year after making a conversion to reverse it and avoid the related tax. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

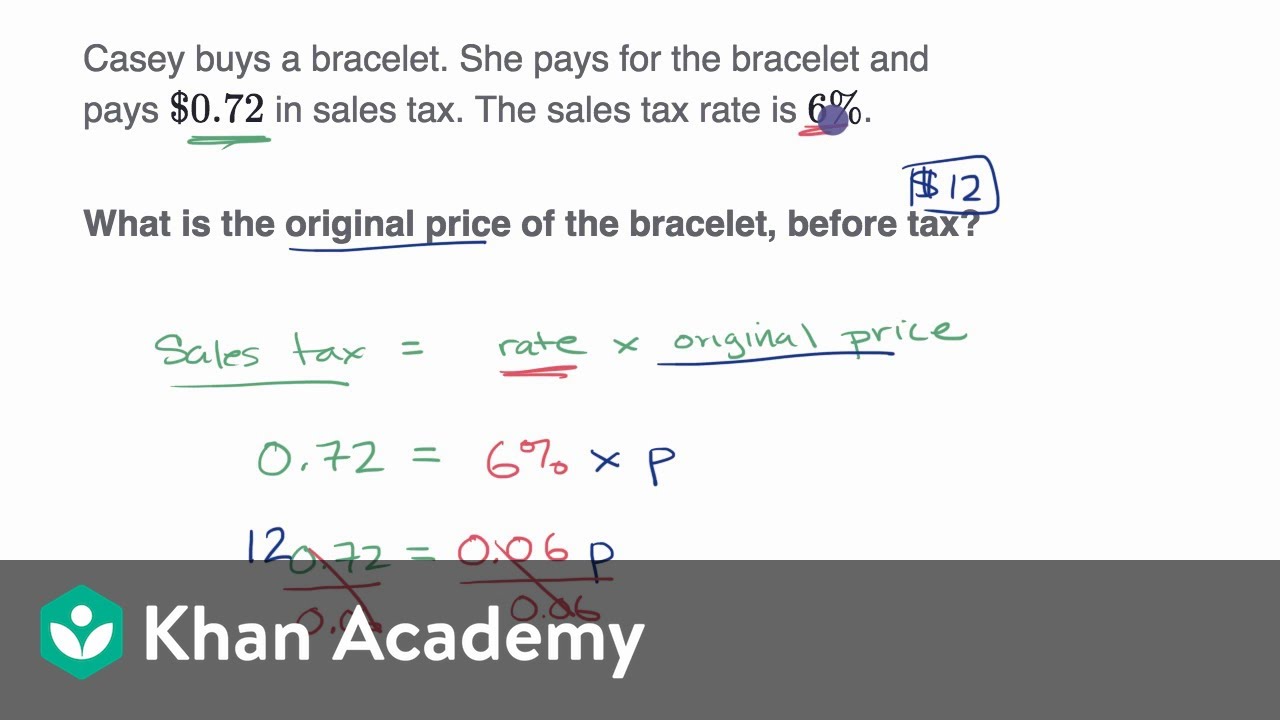

The Sales Tax Formula used to calculate the final price inclusive of tax before tax price in case of Reverse Sales Tax is provided below. Here is how the total is calculated before sales tax. Reverse Sales Tax Calculations.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Reverse Sales Tax Calculator Ny. PRETAX PRICE POSTTAX PRICE 1 TAX RATE.

Before-tax price sale tax rate and final or after-tax price. Enter an amount into the calculator above to find out how what kind of sales tax youll see in New York New York. Formula s to Calculate Reverse Sales Tax.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Reverse Sales Tax Calculator to calculate price before tax and the tax amount based on the final price and sales tax percentage. The reverse sale tax will be calculated as following.

Our free online New York sales tax. There is a state sales tax as well as by city county or school district rates. Calculate Reverse Sales Tax.

If you would like to see a list of states. New york state sales tax. And several of these states.

New York has a 4 statewide sales tax rate but. Plus Tax Amount 000. Just enter the five-digit zip.

Sellers pay a combined nyc nys transfer tax rate of 2075 for sale. Tax Return Calculator at Etax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

New York state has a progressive income tax system with rates ranging from 4 to 109 depending on. Sales tax for small businesses. The harmonized sales tax or hst.

Minus Tax Amount 000. The second script is the reverse of the first. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax.

You can calculate the Sales Tax amount you paid employing any reverse Sales Tax Calculator sometimes called the Sales Tax deduction calculator or. If you know the total sales price and the sales tax percentage it will calculate the. Sales TaxFinal Price Inclusive of Tax Before Tax.

Tax reverse calculation formula. You can use our New York Sales Tax. Tax rate for all canadian.

Used Vehicles for Sale in Bayside NY.

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

2022 2023 Tax Brackets Rates For Each Income Level

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Sales Tax Guide For Online Courses

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator Calculator Academy

Tax News Comment April 2017 Law Offices Of David L Silverman

Us Sales Tax Calculator Reverse Sales Dremployee

Automatically Collect Tax On Invoices Stripe Documentation

Sales Tax Guide For Online Courses

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Reverse Sales And Use Tax Audits The Most Frequently Asked Questions

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

Percent Word Problems Tax And Discount Video Khan Academy

Biden Corporate Tax Increase Details Analysis Tax Foundation

New York Rangers Authentic Adidas Reverse Retro Hockey Jersey Ebay